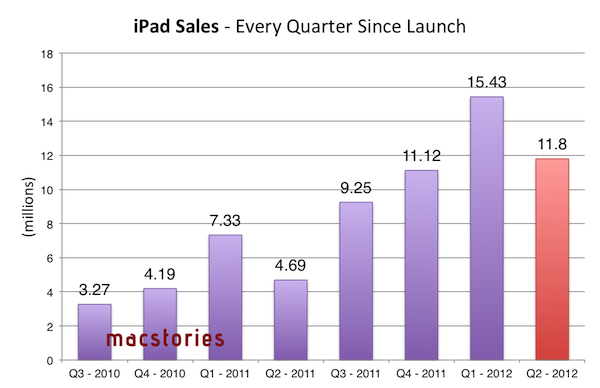

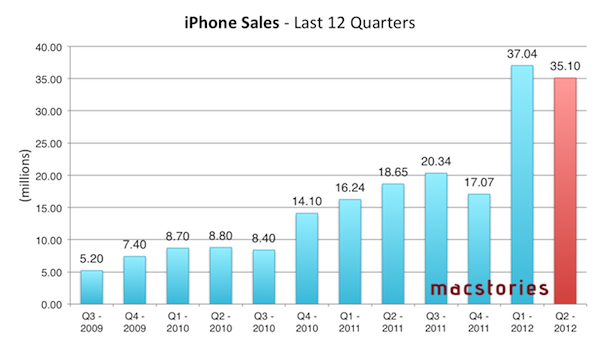

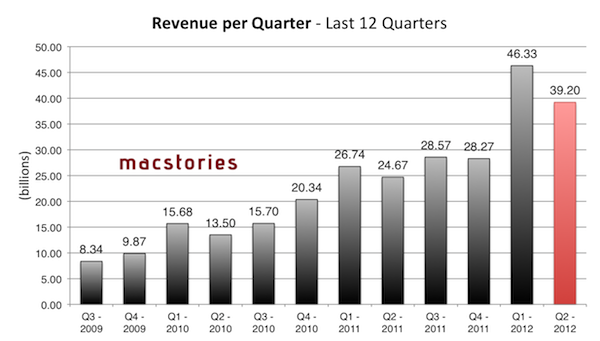

Apple has just posted their Q4 2012 financial results for the quarter that ended on September 29, 2012. The company posted revenue of $36 billion ($8.67 per diluted share), with 14 million iPads, 26.9 million iPhones and million 4.9 Macs sold. Apple sold 5.3 million iPods. The company reported quarterly net profit of $8.2 billion. Gross margin was 40.0 percent compared to 40.3 percent in the year-ago quarter. International sales accounted for 60 percent of the quarter’s revenue.

In this quarter, Apple’s Board of Directors has declared a cash dividend of $2.65 per share of the Company’s common stock.

The dividend is payable on November 15, 2012, to shareholders of record as of the close of business on November 12, 2012.

From the press release:

We’re very proud to end a fantastic fiscal year with record September quarter results,” said Tim Cook, Apple’s CEO. “We’re entering this holiday season with the best iPhone, iPad, Mac and iPod products ever, and we remain very confident in our new product pipeline.

We’re pleased to have generated over $41 billion in net income and over $50 billion in operating cash flow in fiscal 2012,” said Peter Oppenheimer, Apple’s CFO. “Looking ahead to the first fiscal quarter of 2013, we expect revenue of about $52 billion and diluted earnings per share of about $11.75.

Estimates and Previous Quarters

For Q4 2012, Apple had set its guidance at revenue of about $34 billion and diluted earnings per share of about $7.65.

The Street consensus’ average estimate was earnings of $8.75 per share and revenue of $35.80 billion.

On October 24, 2012, both independent and “pro” analysts polled by Fortune (68 in total) forecasted earnings and revenue higher than Apple’s guidance, as it often happens.

After getting clobbered quarter after quarter for nearly four years by a bunch of bloggers, day traders and other amateur analysts, the professionals seem to be giving their clients more realistic numbers. And having badly misjudged two of the last four quarters, the more bullish independents have, for the most part, started to come back to earth.

In Fortune’s poll, the “pros” averaged earnings per share of $8.82 on sales of $36.02 billion; the independent analysts forecasted earnings of $10.14 on sales of $38.8 billion.

Horace Dediu of Asymco also published his forecast for Apple’s fourth fiscal quarter on September 20, 10 days before the quarter (and fiscal year) ended. As he notes, it’ll be difficult to predict iPhone sales for the quarter as consumers have been probably holding off their purchase due to rumors of a product refresh. Furthermore, the iPhone 5 has only been on sale during the quarter for 8 days: the device went on sale in 9 countries on September 21, and 22 more on September 28. Apple only stated that iPhone 5 sales topped over 5 million units during the opening weekend.

The iPhone is going to be extremely difficult to project. On one hand we have the launch of the i5 which will account for about 10 million units in the quarter, on the other, chances are that sales were very weak prior to the launch as purchases were being deferred even more than during the last quarter.

Horace Dediu’s forecast was the following:

- iPhone units: 27.8 million (62%)

- Macs: 5.6 million (15%)

- iPads: 18.8 million (69%)

- iPods: 5.6 million (–15%)

- Music (incl. app) rev. growth: 40%

- Peripherals rev. growth: 10%

- Software rev. growth: 15%

- Total revenues: $39.5 billion (40%)

- GM: 42%

- EPS: $9.75 (38%)

A better picture of iPhone 5 sales, as well as those from the iPad mini, iPad 4, and recently-updated Macs, will be offered by Apple’s current holiday quarter – Q1 2013.

In the previous quarter, Q3 2012, Apple posted revenue of $35 billion, with 17 million iPads, 26 million iPhones and 4 million Macs sold. iPhone represented a 28 percent unit growth over the year-ago quarter, while iPad reported a 84 percent unit increase over the year-ago quarter. Apple sold 6.8 million iPods, a 10 percent unit decline from the year-ago quarter. The company posted quarterly net profit of $8.8 billion, or $9.32 per diluted share. International sales accounted for 62 percent of the quarter’s revenue.

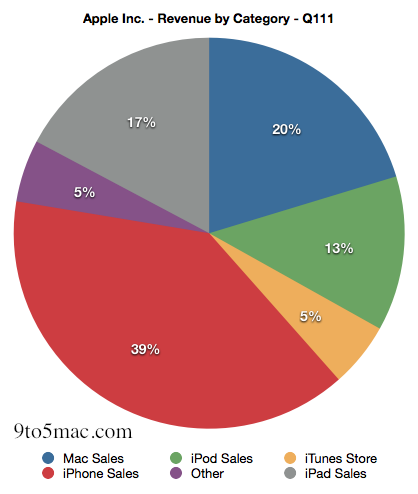

In the year-ago-quarter, Q4 2011, Apple posted record-breaking revenue of $28.27 billion, with 11.12 million iPads, 17.07 million iPhones and 4.89 million Macs sold.

Apple will provide a live audio feed of its Q4 2012 conference call at 2:00 PM PT, and we’ll update this story with the conference highlights. You can find the full press release and a graphical visualization of Apple’s Q4 2012 after the break. Read more