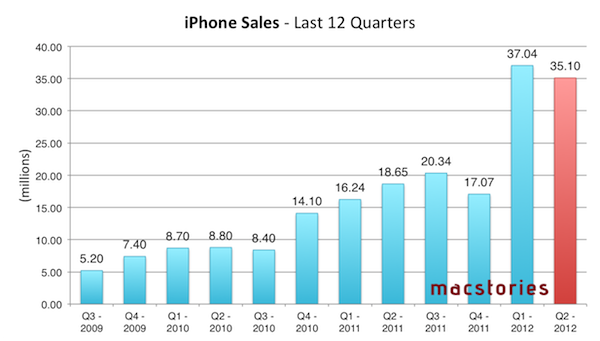

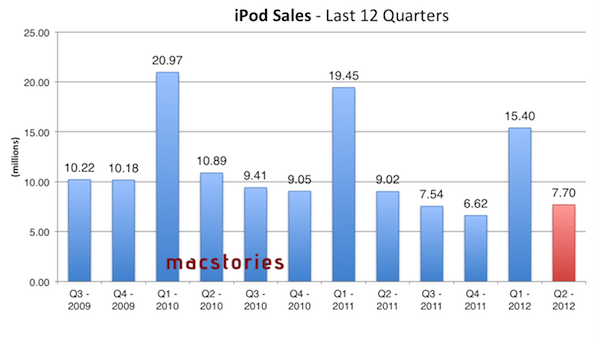

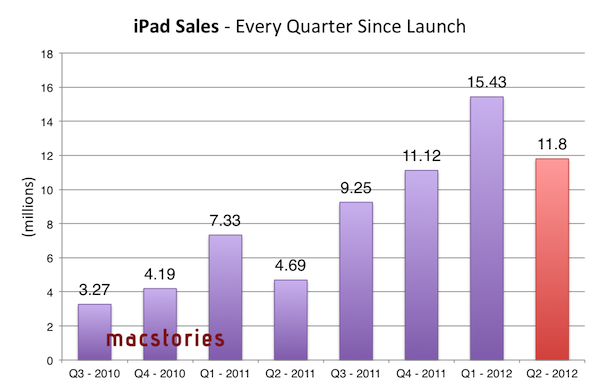

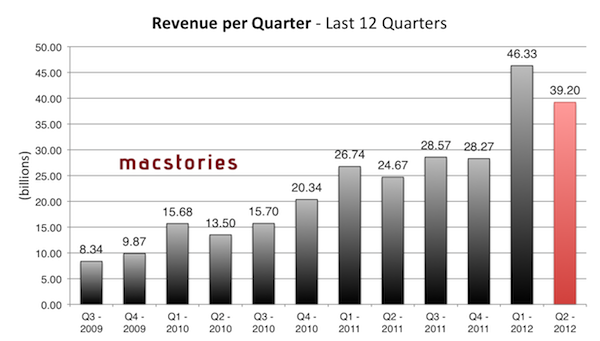

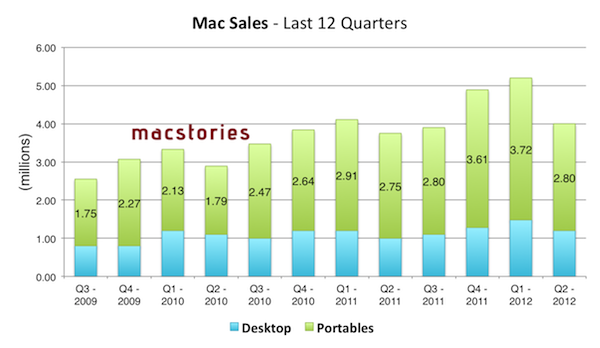

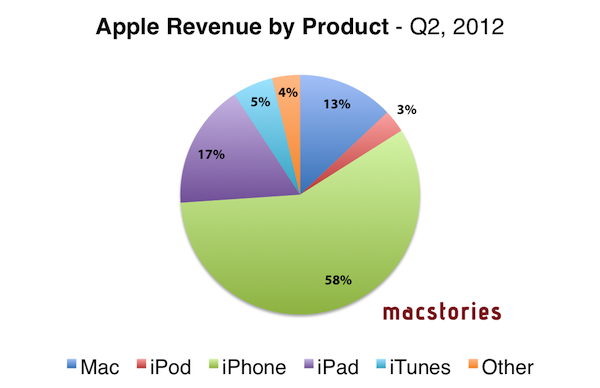

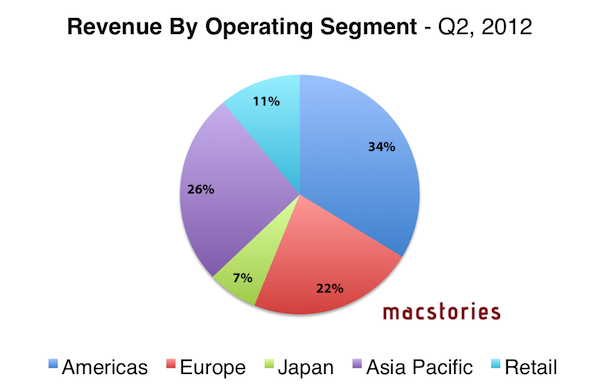

Apple has just posted their Q2 2012 financial results for the quarter that ended on March 31, 2012. The company posted revenue of $39.2 billion, with 11.8 million iPads, 35.1 million iPhones and 4 million Macs sold. Apple sold 7.7 million iPods, a 15 percent unit decline from the year-ago quarter. The company posted quarterly net profit of $11.6 billion, or $12.30 per diluted share. iPhone represented a 88 percent unit growth over the year-ago quarter, while iPad reported a 151 percent unit increase over the year-ago quarter. International sales accounted for 64 percent of the quarter’s revenue.

We’re thrilled with sales of over 35 million iPhones and almost 12 million iPads in the March quarter,” said Tim Cook, Apple’s CEO. “The new iPad is off to a great start, and across the year you’re going to see a lot more of the kind of innovation that only Apple can deliver.”

“Our record March quarter results drove $14 billion in cash flow from operations,” said Peter Oppenheimer, Apple’s CFO. “Looking ahead to the third fiscal quarter, we expect revenue of about $34 billion and diluted earnings per share of about $8.68.

Estimates and Previous Quarters

For Q2 2012, Apple set its guidance at $32.5 billion revenue and diluted earnings per share of about $8.50.

The Street consensus’ estimate was earnings of $10.06 per share and revenue of $36.81 billion; on April 1, 2012, 16 independent analysts polled by Fortune forecasted earnings of $12.66 per share and revenue of $42.68 billion. On April 23, Philip Elmer-Dewitt put together an updated chart tracking predictions from 23 independent and 34 Wall Street analysts.

In Q1 2012 – the company’s biggest quarter to date – Apple posted record-breaking revenue of $46.33 billion, with 15.43 million iPads, 37.04 million iPhones and 5.2 million Macs sold. Apple sold 15.4 million iPods, a 21 percent unit decline from the year-ago quarter. The company posted quarterly net profit of $13.06 billion, or $13.87 per diluted share. iPhone represented a 128 percent unit growth over the year-ago quarter, while iPad reported a 111 percent unit increase over the year-ago quarter. In the year-go quarter, Apple posted revenue of $24.67 billion, with 4.69 million iPads, 18.65 million iPhones, and 3.76 million Macs sold.

As we reported in our Q1 2012 coverage:

Apple CEO Tim Cook remarked how the company was seeing China as “an extremely important market”, with “staggering demand” for iPhone. Cook also revealed that, in spite of the “bold bet” they took in terms of iPhone supply, Apple was short of iPhone supply throughout the quarter; the situation had improved by the time of the earnings call, but the company was still short in some areas. In the conference call, Cook also referred to iCloud as the company’s “big insight” for the next decade.

In his own estimates for the upcoming Q2 results, Asymco’s Horace Dediu had forecasted the following numbers:

- iPhone units: 37.3 million (100%)

- Macs: 4.7 million (25%)

- iPads: 12.2 million (160%)

- iPods: 7 million (-22%)

- Music (incl. app) rev. growth: 40%

- Peripherals rev. growth: 25%

- Software rev. growth: 10%

- Total revenues: $42.7 billion (growth: 73%)

- GM: 44.7%

- EPS: $12.0 (88%)

Apple will provide a live audio feed of its Q2 2012 conference call at 2:00 PM Pacific, and we’ll update this story with the conference highlights. You can find the full press release and a graphical visualization of Apple’s Q2 2012 after the break.

A recap of estimates and product releases happened during the quarter is available here.

Graphical Visualization

We have compiled a series of graphs and charts to offer a graphical visualization of Apple’s third quarter. (click for full-size, compare to Q1 2012 here)

Notes From The Call

- Peter Oppenheimer: New record for March quarter, second only to December quarter, fueled by iPhone and iPad sales.

- New records for desktops and portables with 4 million Macs sold in March quarter.

- Mountain Lion to be available “late summer” from the Mac App Store.

- Strong iPhone sales growth in all segments: Asian Pacific segment strong (where sales doubled), China – sales 5x level compared to YOY in Greater China.

- iPhone 4S available in 100 countries on 230 carriers.

- The iOS ecosystem continues to expand.

- Over 600,000 apps are now available on the App Store.

- 200,000 apps specifically made for iPad.

- iTunes now has over 28 million songs.

- Cumulatively, iOS devices have sold over 365 million units to date.

- iCloud now has 125 million customers since its launch in October.

- Half Macs this quarter have been sold to new customers.

- Average revenue per retail store is $12.2 million, compared to $9.9 million YOY.

- 85 million visitors, compared to 71 million YOY, 19% increase.

- Average 18,000 visitors per store per week.

- Cash securities now over $102 billion, compared to $96 billion.

- New iPad is off to “tremendous start”.

- “We’re excited about fabulous products in the pipeline”.

- New iPad had the fastest country rollout ever, satisfied new demand compared to last year.

- From Q&A

- Q: Uptake of iPad 2 phenomenal in March – what does that tell you about potential to move to lower iPad price over time? - Tim Cook: We’re just learning about elastics of demand and the $399 price point. It’s doing well, but new iPad is on fire, and we’re selling iPads as fast as we can make them. We’ll learn more over this quarter and over education buying season.

- TC: This is the 24th straight quarter that Mac sales have outgrown the overall PC market.

- TC: On iPad 2, we’re actually thrilled with the results we’ve seen. As Peter said, it’s only been a few weeks. It’s too early to come to a clear conclusion. From what we are seeing - the new price point unlocked some education demand to price sensitive customers. In several other countries, there was a marked change in demand at that price point. We feel great about its early going. On iPhone: we’re happy with news we’ve made and pricing just a few months ago on 3GS and 4. Both of them contribute to the ability to achieve 35 million in sales, 2nd highest quarter of all time.

- Q: Can you talk about how you think about markets for tablet and PC devices will shape going forward? Why do you believe tablets and PCs won’t converge? Why are markets separate? TC: Anything can be forced to converge, but problem is about trade-offs, and you end up with trade-offs that don’t please anyone.

You can converge a toaster and refrigerator, but the end result won’t be pleasing to the user.

We were using them (iPads) here and it was clear to us that there was so much you could do and the reasons people would use them would be so broad. iPad has taken off for consumers, education, and enterprise – and it’s everywhere you look. Apps are so easy to make very meaningful for someone and they’re so abundant – as ecosystem gets better, I think that the… limit is nowhere in sight.

We’ve now – which is just 2 years after initial iPad – we’ve sold 67 million. In context, it took us 24 years to sell that many Macs, 5 years for that many iPods, and over 3 years for that many iPhones. I think iPad - it’s a profound product - breadth is incredible - and appeal is universal. I could not be happier with being in a market in which we’re innovating. Product and ecosystem are incredible. Having said that, I believe there is a good market for MacBook Air. We continue to innovate in that product. It appeals to someone who has different requirements. If you put them together, they compromise both and not please either user. Some people will own both - that’s great - but I think to make compromises of convergence, we’re not going to that party. Others might defensively. But we’re going to play in both.

- TC: Our focus is on making the very best smartphone. The user experience is off the charts; at end of day; I think carriers want to provide what customers want to buy. That’s what they’re motivated for. Most important thing by far is for Apple to continue making great products customers want. We’re committed to doing this and innovating at an unbelievable pace in this area.

- TC: We had an incredible quarter in China: record $7.9 billion in Greater China – up over 3 times YOY. It is mind boggling that we could do this well, and part of this is pent up demand for iPhone 4S. It launched in mainland China this year – China was not able to get into Q1 period, all of that is in Q2.

- PO: We’re thrilled with the rate we’re adding content to iTunes. This is something we have to do country by country so it takes a bit of time. We have the largest catalogue of songs and movies available anywhere - over 28 million songs - 1.9 billion in revenue in March quarter, up 35% year-over-year.

- TC: On iPad, worldwide we’re supply constrained coming out of last quarter. In China - on macro basis - China has an enormous number of people moving into middle class, and this is creating demand for goods. There’s tremendous opportunity for companies that understand China, and we’re doing everything we can to understand it and serve market as good as we can.

- TC: Spain has been weak for us, and more broadly for many companies. We grew in Spain, but materially less than Europe or worldwide. This is not related to carriers - Spain is just in a terrible economic situation.

- Q: In terms of flexibility, would Apple settle rather than wage ongoing litigation with patent war? TC: I hate litigation. I continue to hate it. I just want people to invent their own stuff. I would highly prefer to settle vs. battle. Apple should not become a developer for world. We need people to invent their own stuff.

- Tim Cook: I am confident we will be able to supply a significant number of iPads during the quarter. I feel confident about that, but it’s tough to know it will balance until you get there. I am confident with improving supply and total number will be significant.

Storify

We have created a Storify stream of tweets, images, quotes and links about Apple’s Q2 2012. Check it out below.