Late last week Apple made a preliminary submission to the Australian Competition and Consumer Commission in relation to the request for permission from various Australian banks to boycott Apple Pay and collectively negotiate with Apple. Apple’s submission is comparatively brief at just three pages, but it clearly highlights the approach Apple will take in opposing the banks’ request.

In its submission, Apple is quick to highlight the collective dominance of the banks in Australia which account for 66% of credit card balances in Australia, whilst characterising itself as the “new entrant to the Australian market” having only launched Apple Pay in November 2015.

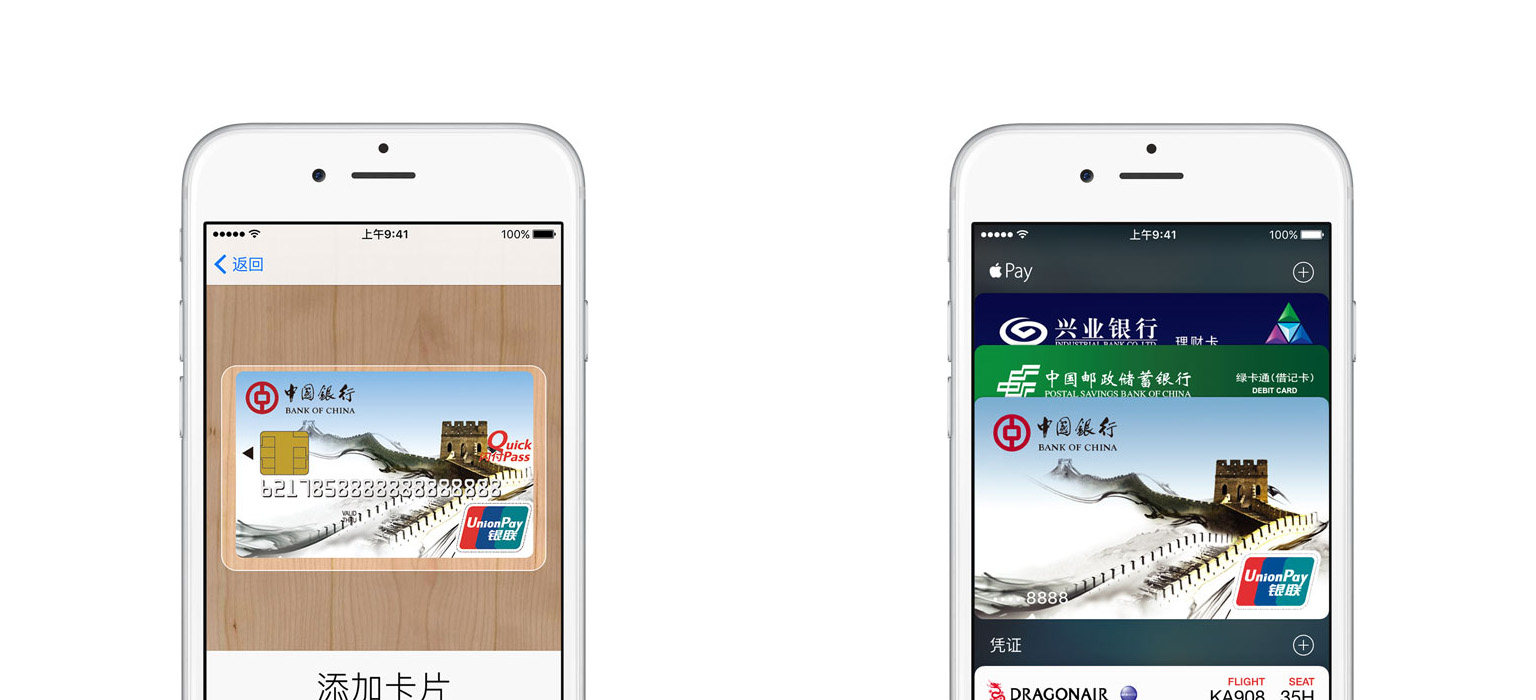

The other angle of attack from Apple is more surprising, and in the submission it appears quite clear that Apple is asserting that the closed nature of the NFC antenna in the iPhone is pivotal to maintaining the security of its users.

Now they ask the ACCC for explicit permission to negotiate with Apple as a collective group. The goal of which is to force Apple and other third party providers to accept their terms, allow them to charge consumers that choose to use Apple Pay, and force Apple to undermine the security of its mobile payment service by opening access to the NFC antenna, placing at risk the consumer experience of a simple, secure, and private way to make payments in store, within, applications, or on the web.

Apple notes that it will make a further, more comprehensive submission, at a later date. But a key purpose of this prelimary submission was to persuade the ACCC that the banks should not be given any interim approval, and that the ACCC should take the “normal 6 month statutory period for assessment”.

A few other interesting tidbits from Apple’s submission:

- Apple’s discussions with Australian banks in relation to Apple Pay began in “late 2014”. Apple Pay launched in the US in October 2014.

- One of the applicant banks “has refused to even enter into a confidentiality agreement with Apple to allow for preliminary discussions about the terms under which it would participate in Apple Pay”.

- Apple argues that “interim authorisation of a collective boycott will have a lasting and irreversible impact on the adoption of Apple Pay and other third party wallets, and the Australian payment market”.

- Apple suggests that Apple Pay is not a competitive threat to the banks; “Unfortunately, and based on their limited understanding of the offering, the applicants perceive Apple Pay as a competitive threat”.

- Apple writes “These banks want to maintain complete control over their customers”, I would wager the banks would say the exact same thing about Apple.

(via AFR)