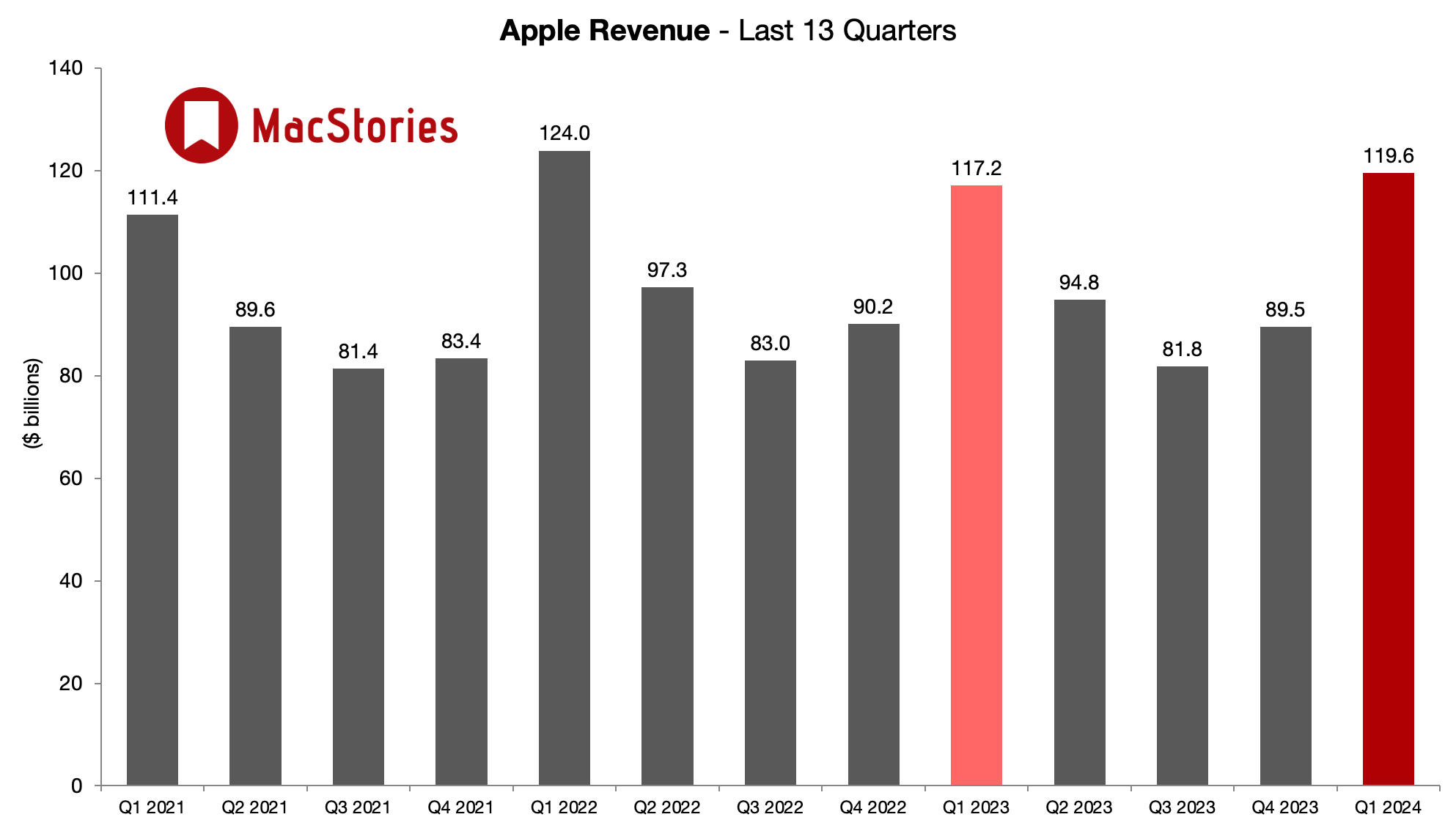

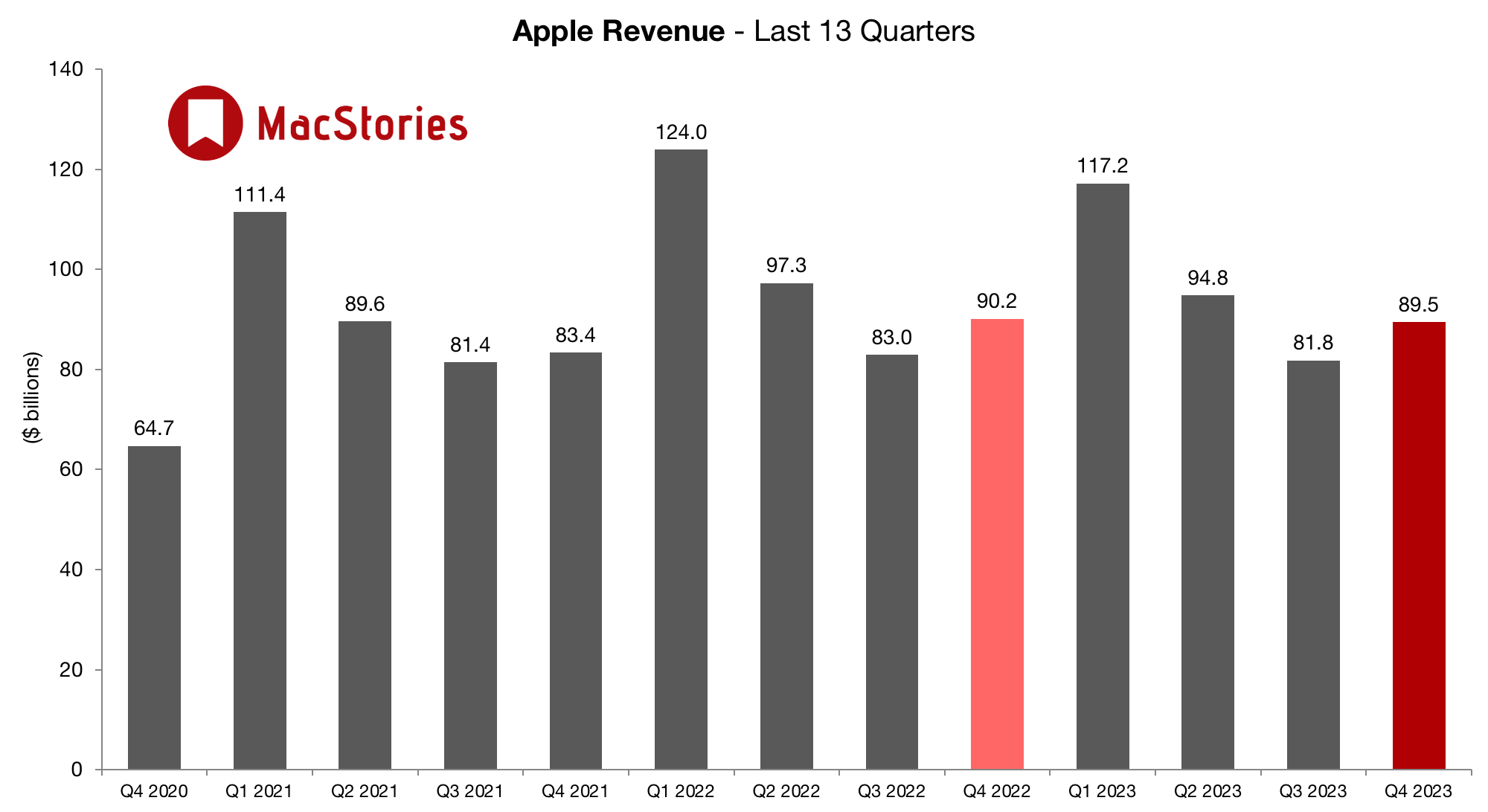

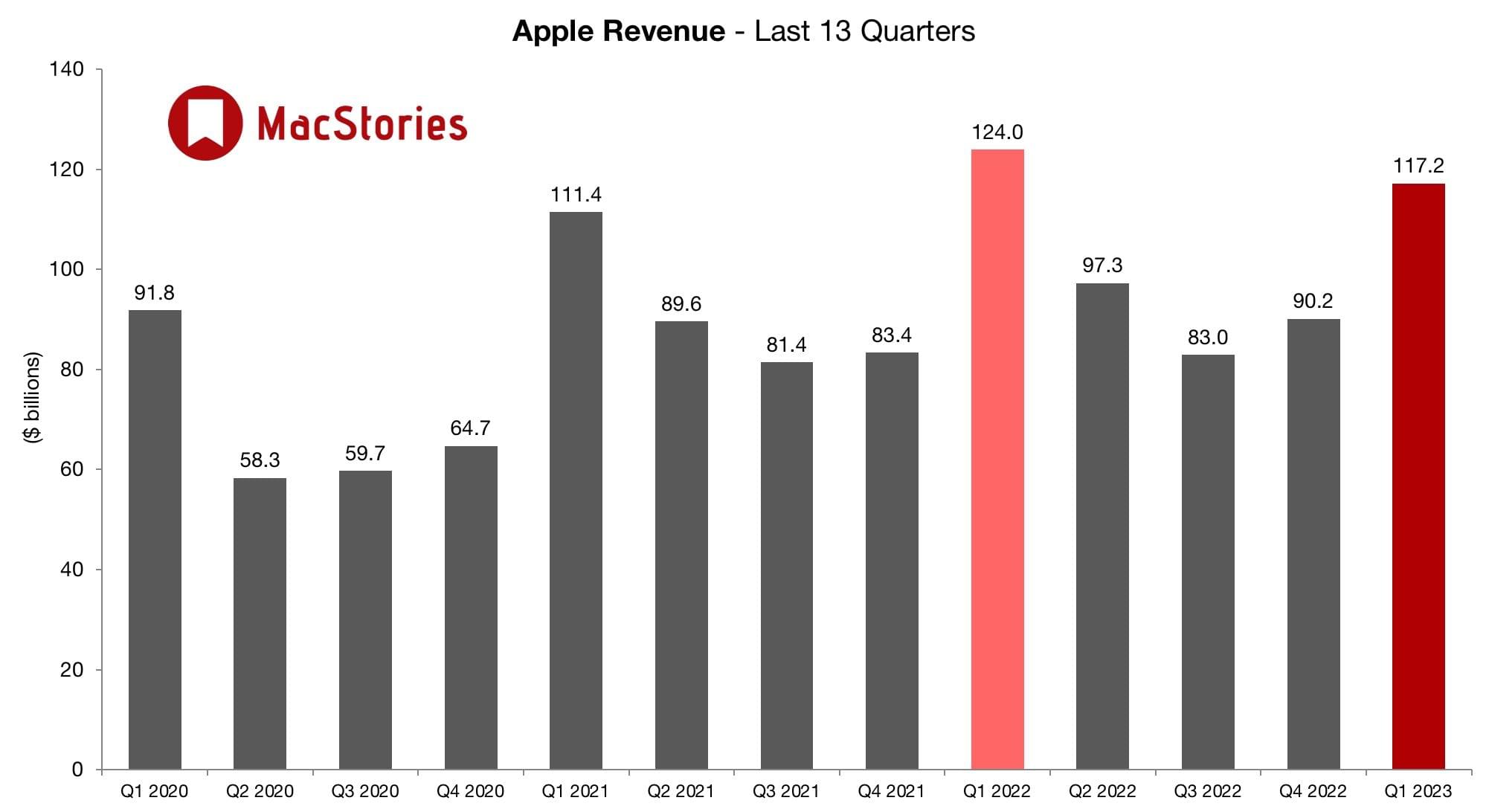

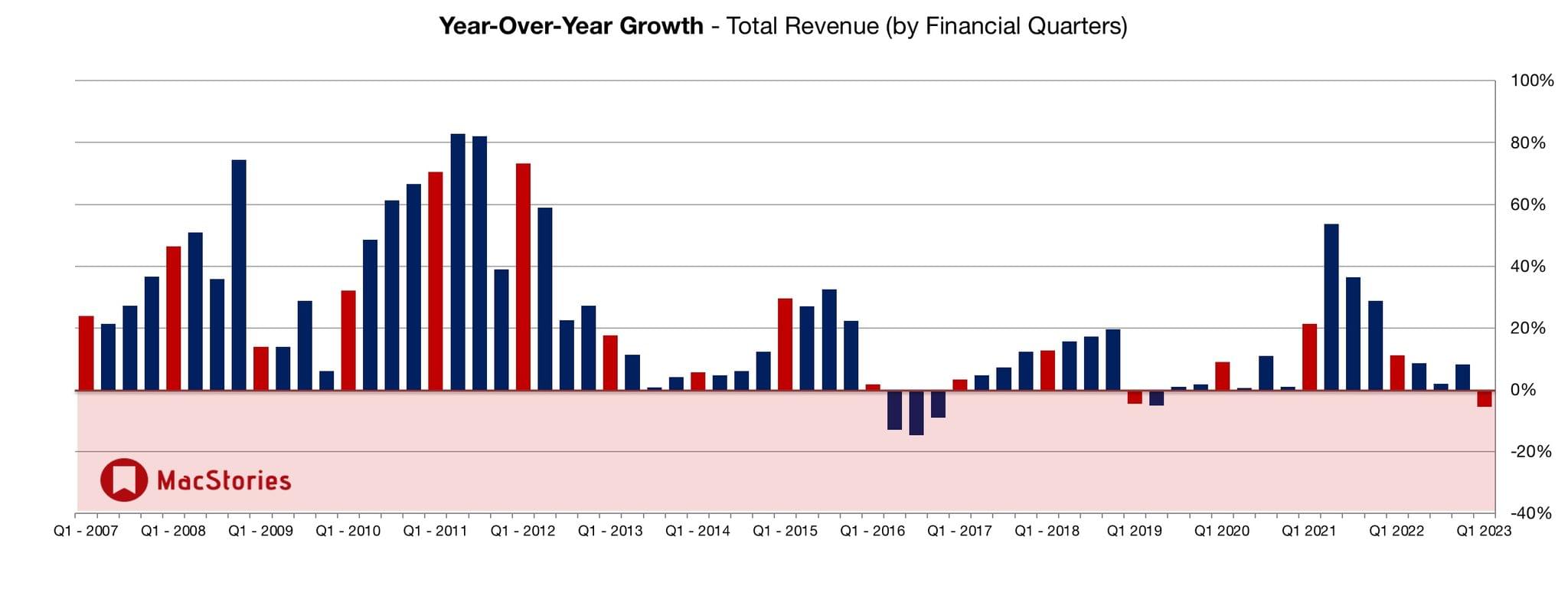

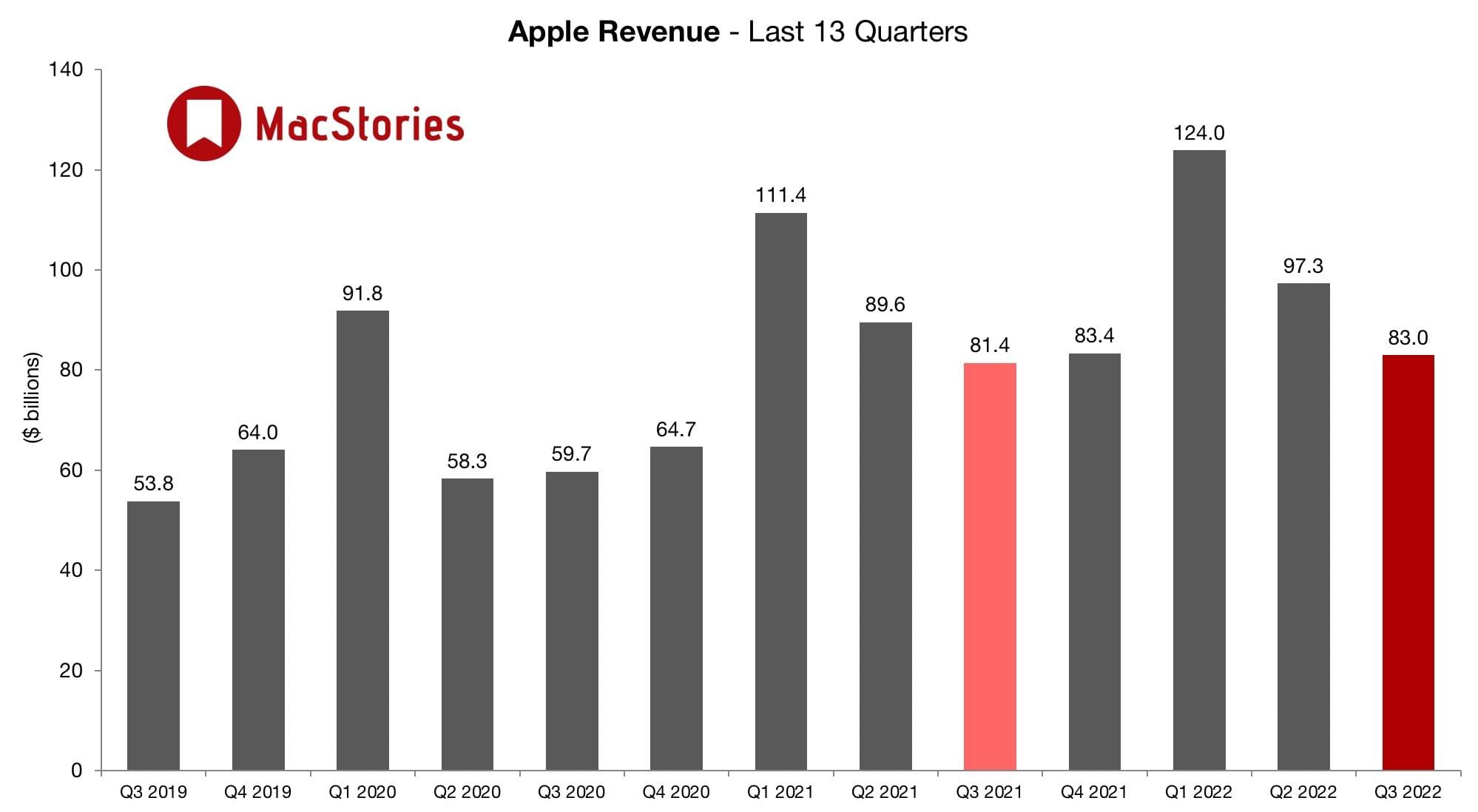

Last quarter, Apple reported that its revenue came in at $89.5 billion, which was down year-over-year but slightly more than expected. Today, the company reported $119.6 billion in revenue for the first quarter of 2024, which include the holiday season and the first full quarter of iPhone 15 sales.

According to Apple CEO Tim Cook:

Today Apple is reporting revenue growth for the December quarter fueled by iPhone sales, and an all-time revenue record in Services. We are pleased to announce that our installed base of active devices has now surpassed 2.2 billion, reaching an all-time high across all products and geographic segments. And as customers begin to experience the incredible Apple Vision Pro tomorrow, we are committed as ever to the pursuit of groundbreaking innovation — in line with our values and on behalf of our customers.

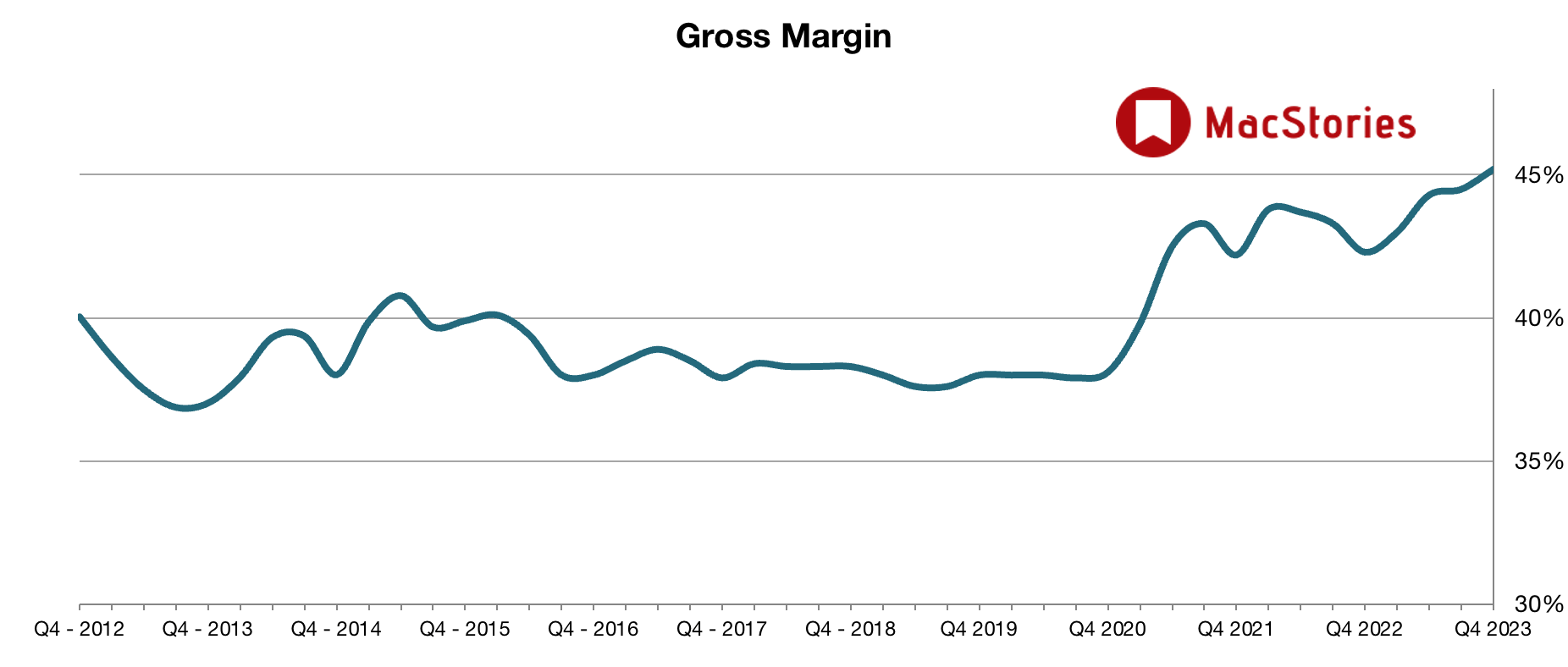

Going into today’s earnings call, the consensus among Wall Street analysts was that Apple would earn $117.97 billion. Apple beat those expectations by a healthy margin of nearly $2 billion. And, with 2.2 billion installed devices, an all-time high, the opportunity for continued growth of service revenue is significant.

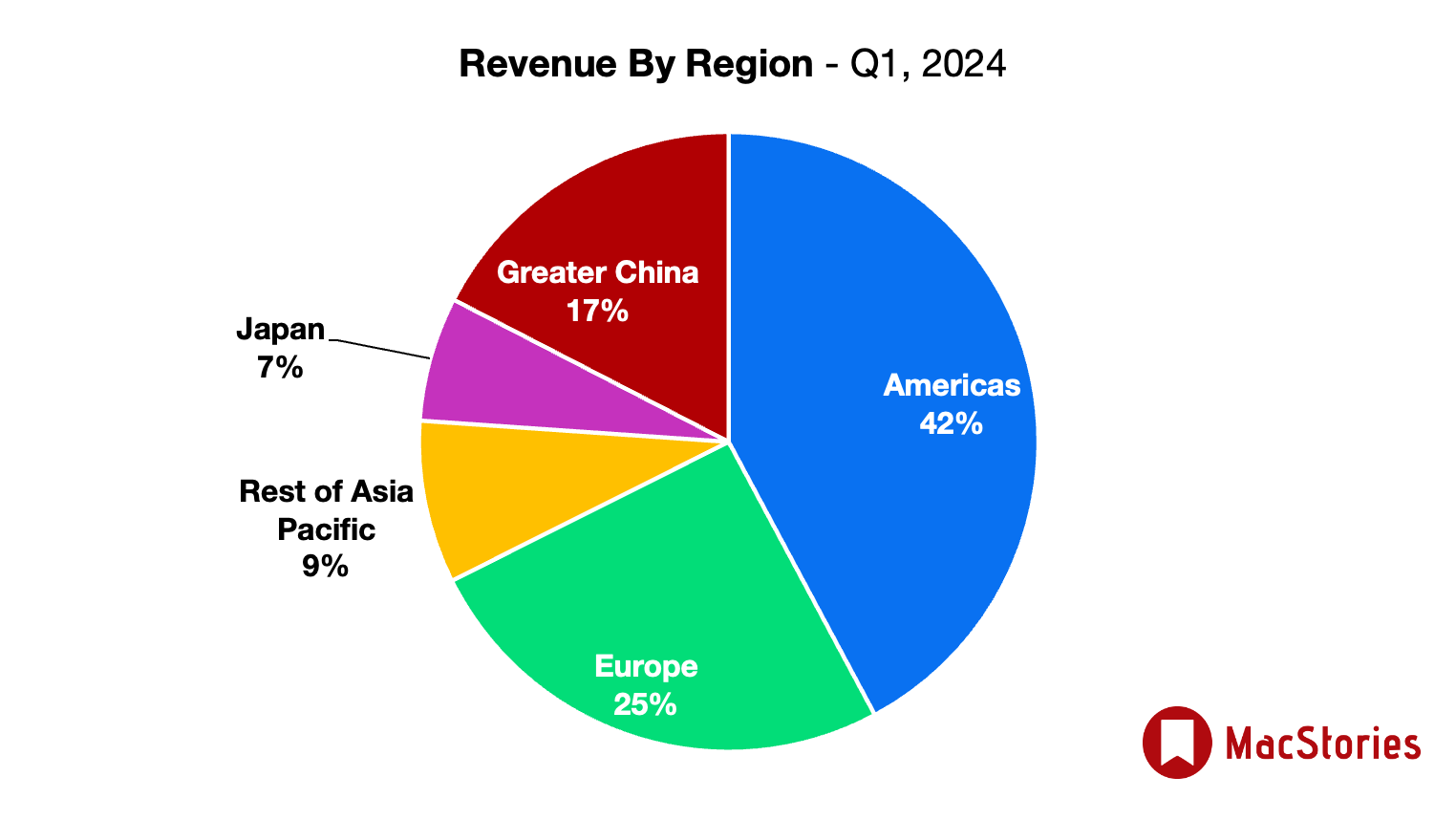

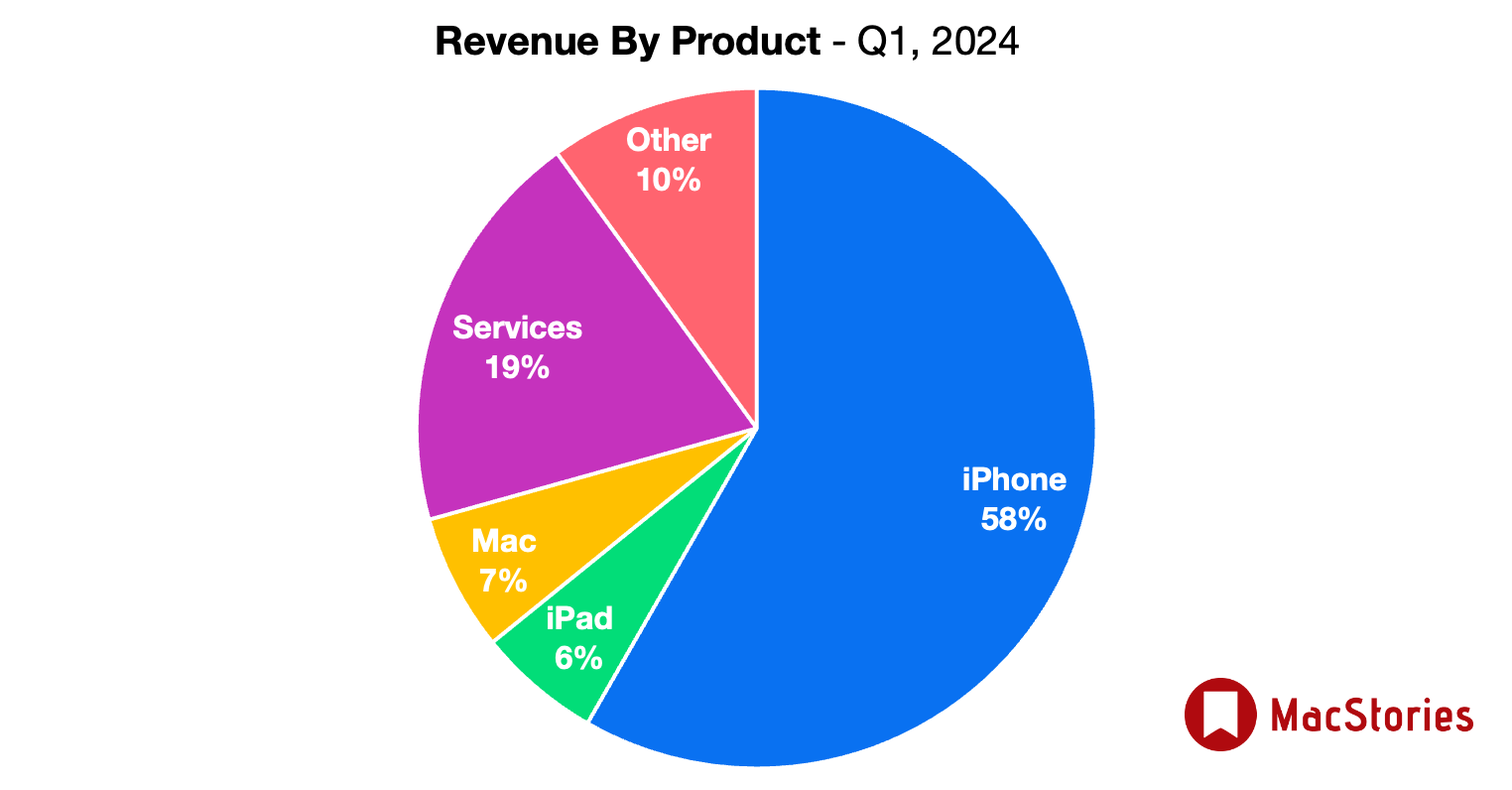

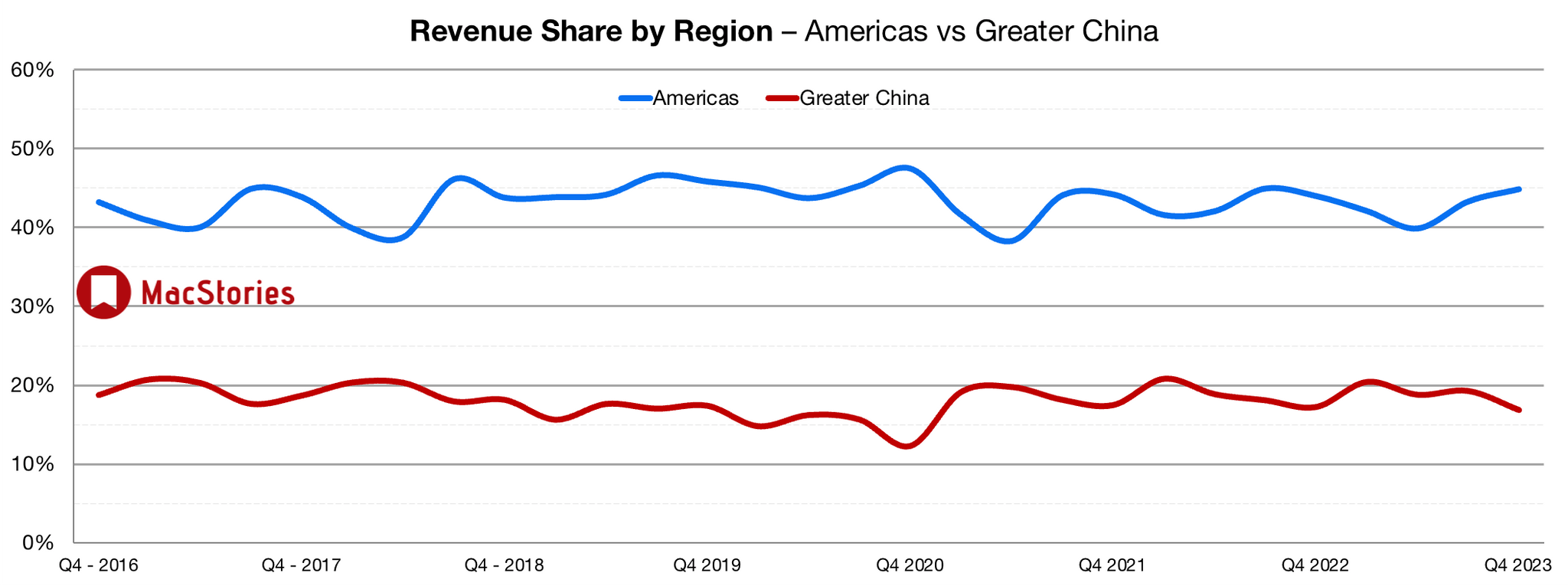

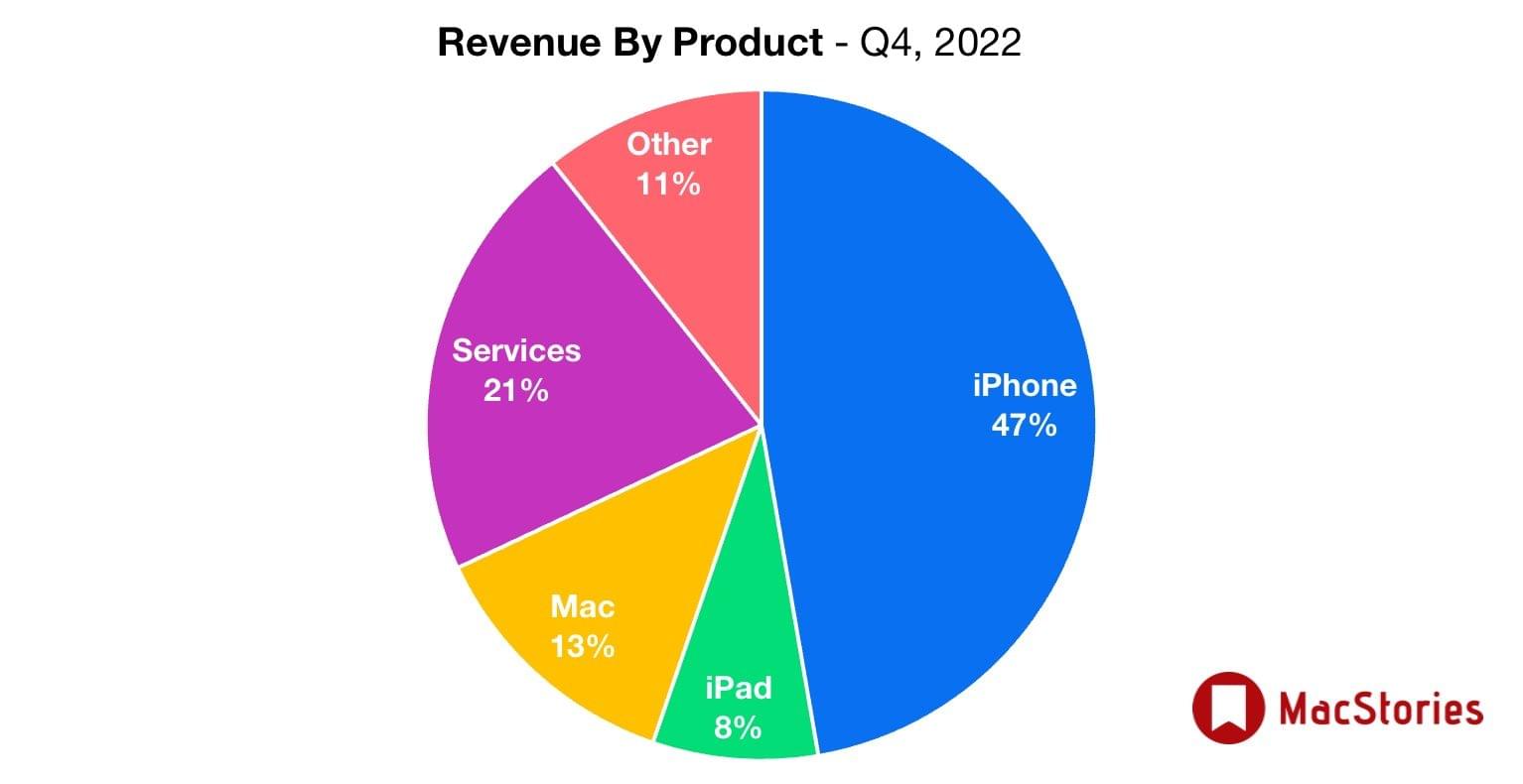

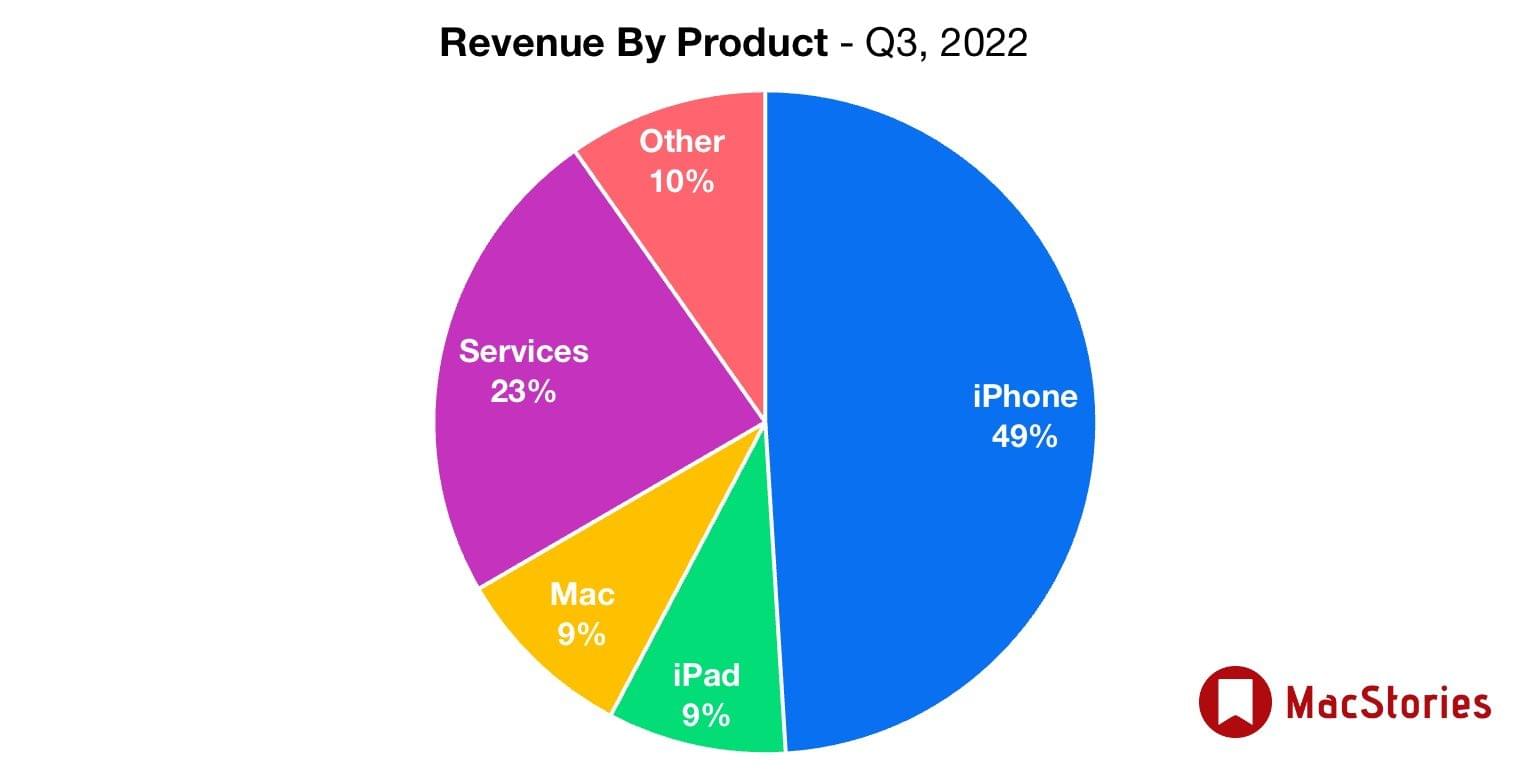

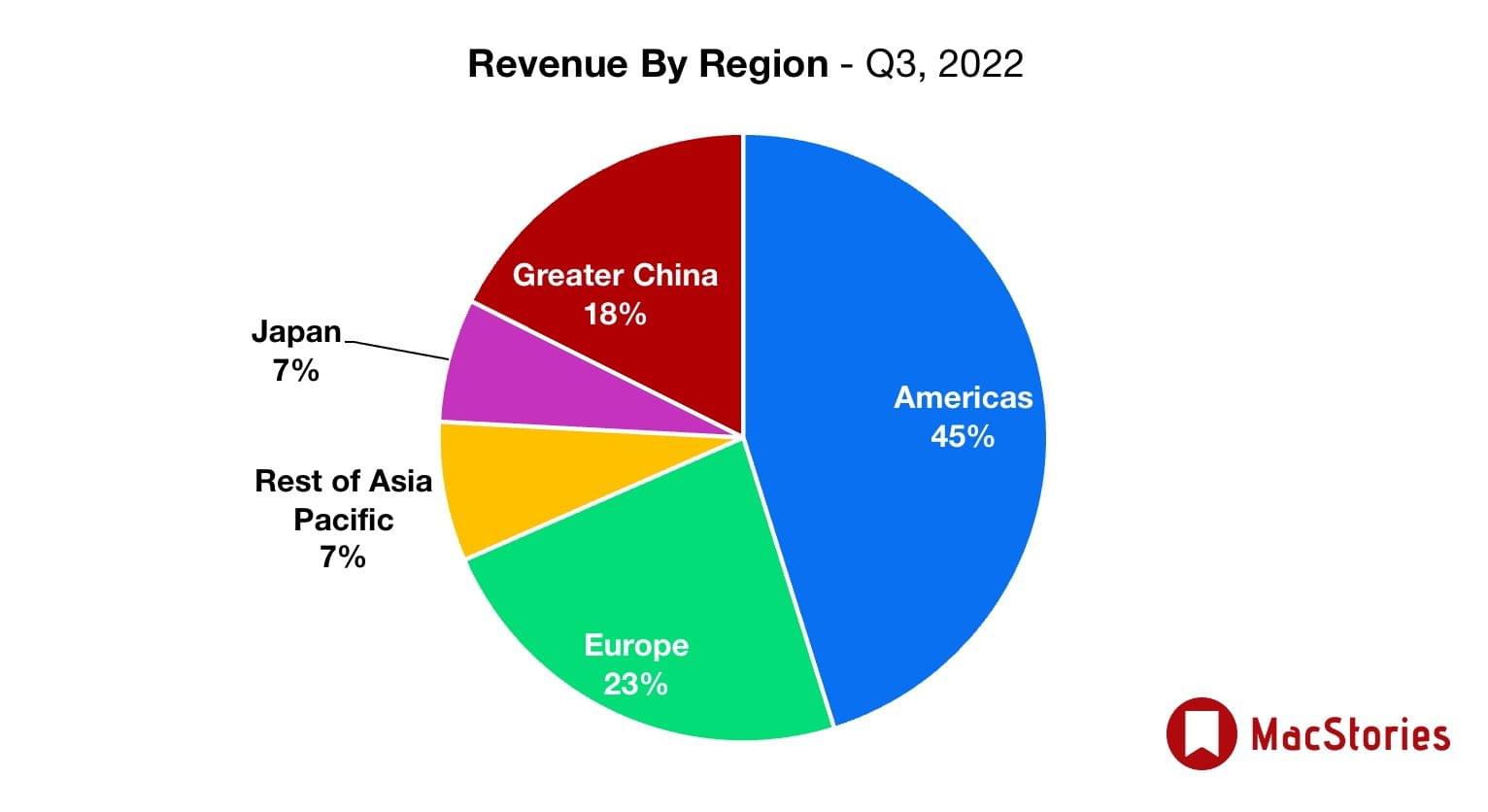

Once again, though, the iPhone was the star of the show with a sizable 58% of Apple’s revenue for the quarter, making up for concerns about consumer demand in China, regulatory pressures in Europe, and questions about whether consumers will embrace Apple Vision Pro.

](https://cdn.macstories.net/967466ed-d433-4313-8ccf-4500db12f669-1659092186095.jpeg)

](https://cdn.macstories.net/14b2f904-114f-48be-9424-b5bd63a7c76a-1659092186097.jpeg)

](https://cdn.macstories.net/image-1659119008915.jpeg)