Last night, Apple updated its Investor Relations webpage to include a placeholder for the company’s next earnings call, scheduled for April 24. As usual with Apple’s conference calls, the event will be provided as an audio webcast for investors and listeners.

Apple plans to conduct a conference call to discuss financial results of its second fiscal quarter on Tuesday, April 24, 2012 at 2:00 p.m. PT.

Ended on March 31, Apple’s second quarter of the fiscal year typically brings in lower sales and volume for the company, although this year’s Q2 may signal a change in this tradition with AAPL soaring to new heights every week, and the new iPad selling very well in a larger number of countries than the iPad 2 last year. In fact, whilst Apple didn’t provide any official numbers for the iPad 2’s release last year, it is safe to assume this year’s debut of the new iPad saw larger sales thanks to a wider rollout on Day One (10 countries on March 16, as opposed to only 1 launch country for the iPad 2), rapid follow-up in more countries a week later (25 countries on March 23) and previously reported initial sales figures (3 million iPads were sold in 4 days, prior to the second worldwide March 23 rollout). Sales from the March 16 and March 23 iPad launches will be included in this year’s Q2 results.

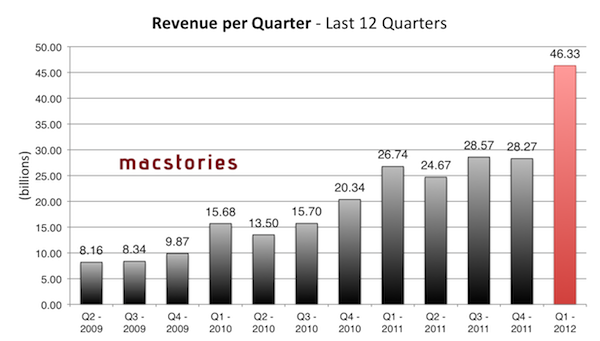

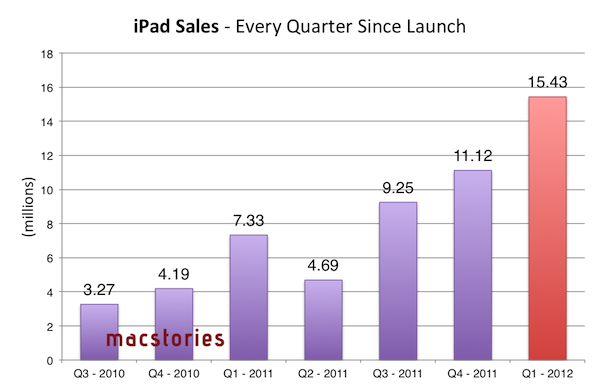

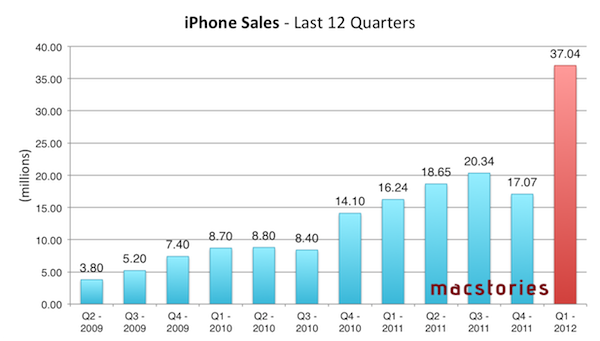

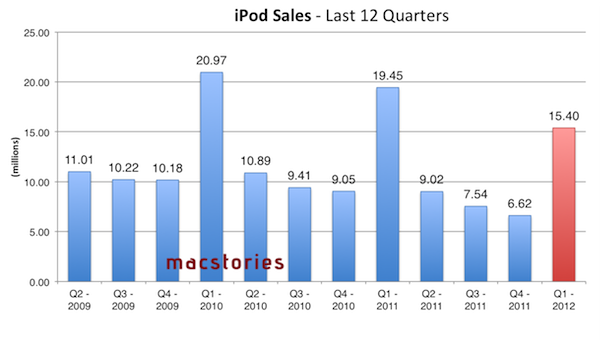

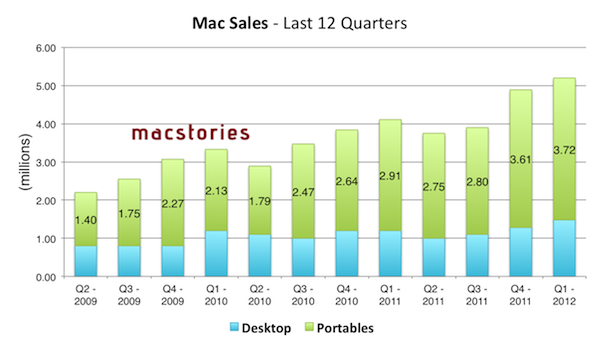

Apple’s previous quarter, Q1 2012, has been the company’s biggest to date. The company posted record-breaking revenue of $46.33 billion, with 15.43 million iPads, 37.04 million iPhones and 5.2 million Macs sold. Apple sold 15.4 million iPods, a 21 percent unit decline from the year-ago quarter. The company posted quarterly net profit of $13.06 billion, or $13.87 per diluted share. iPhone represented a 128 percent unit growth over the year-ago quarter, while iPad reported a 111 percent unit increase over the year-ago quarter. Until Q1 2012, Apple’s most profitable quarter had been Q3 2011 with $28.57 billion revenue.

In Q1 2012, Apple CEO Tim Cook remarked how the company was seeing China as “an extremely important market”, with “staggering demand” for iPhone. Cook also revealed that, in spite of the “bold bet” they took in terms of iPhone supply, Apple was short of iPhone supply throughout the quarter; the situation had improved by the time of the earnings call, but the company was still short in some areas. In the conference call, Cook also referred to iCloud as the company’s “big insight” for the next decade.

For Q2 2012, Apple set its guidance at $32.5 billion revenue and diluted earnings per share of about $8.50. As Apple’s own estimates are generally low, it is no surprise to see analysts projecting bigger sales and revenue, but as noted by Philip Elmer-DeWitt at Fortune, this quarter’s estimates show a great difference between estimates from the “pros” (Wall Street analysts) and the “indies”. With a $6.8 billion gap, Wall Street analysts expect the company to report $35.88 billion revenue, while the indies forecast revenue of $42.68 billion. While more bullish, estimates from the independent analysts tend to be more accurate, with only a few notable exceptions in the past (such as when they failed to predict customers were holding out for an iPhone upgrade in October).

In his own estimates for the upcoming Q2 results, Asymco’s Horace Dediu forecasted the following numbers:

- iPhone units: 37.3 million (100%)

- Macs: 4.7 million (25%)

- iPads: 12.2 million (160%)

- iPods: 7 million (-22%)

- Music (incl. app) rev. growth: 40%

- Peripherals rev. growth: 25%

- Software rev. growth: 10%

- Total revenues: $42.7 billion (growth: 73%)

- GM: 44.7%

- EPS: $12.0 (88%)

To put these possible numbers in context, here’s a graphical representation of how Apple performed in the past quarters.

Apple’s recently announced quarterly dividend won’t begin until the fourth fiscal quarter of 2012. We will provide live updates from the call on our site’s homepage on April 24 starting at 2 PM PT. For a recap of news and events that may have affected Apple’s results in the quarter, check out our January, February, and March In Review sections.