Almost three years ago now, Apple announced that it would support adding state IDs and driver’s licenses to the Wallet app on the iPhone and the Apple Watch, with the feature first rolling out to a handful of US states. Today, digital IDs in Wallet still haven’t materialized in most of the states that committed to support the feature back in 2021, and Apple hasn’t announced any expansion of the feature beyond the US.

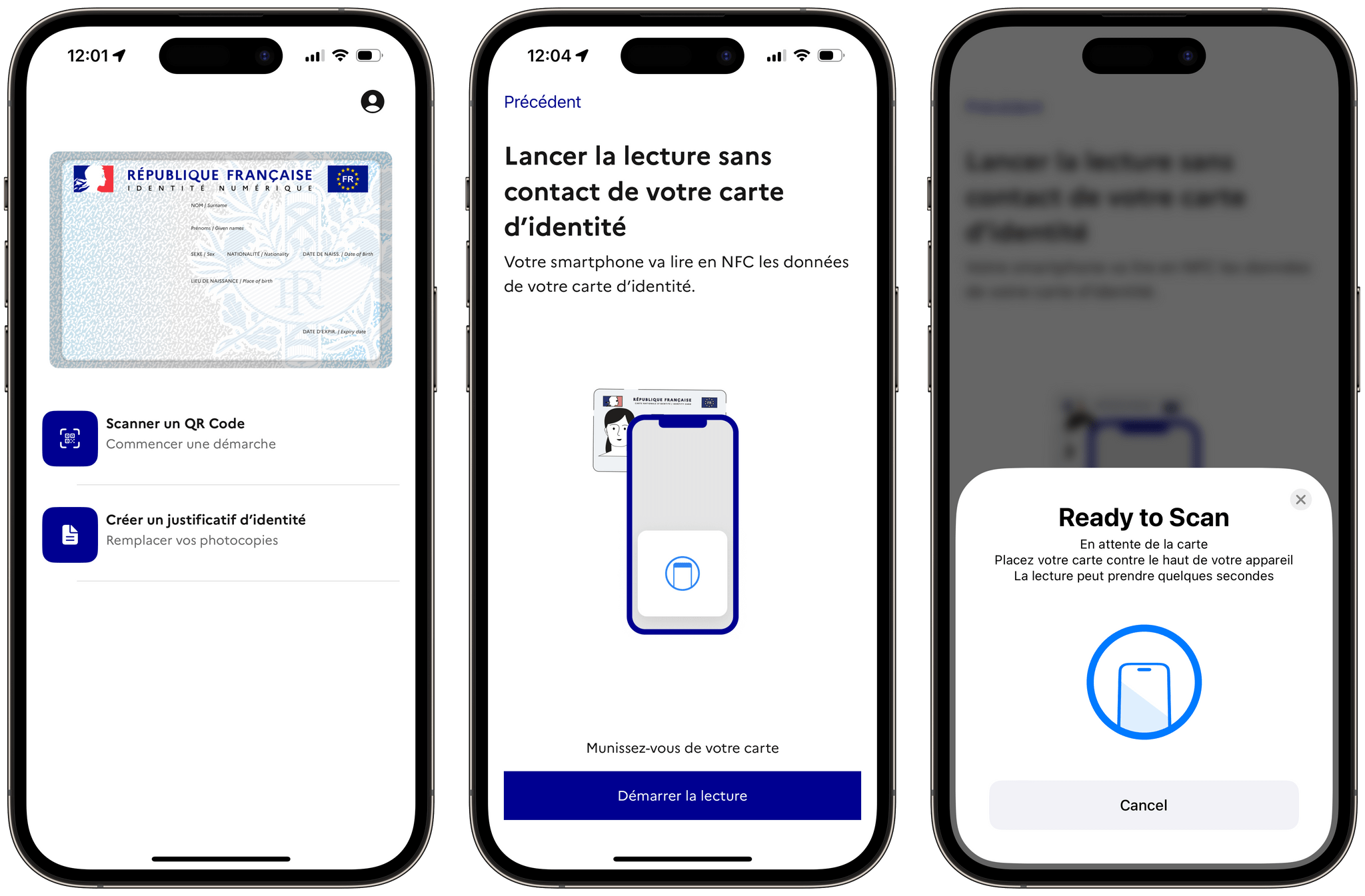

Here in France, the government has long pledged to offer the ability to get a digital ID for all holders of the redesigned national identity card that started rolling out in 2021. The new ID card format was to be smaller than the old one (finally reaching the size of any standard credit card), but more importantly, it would feature an RFID chip that would enable contactless interactivity with, say, a dedicated terminal or any NFC-enabled smartphone. Fast-forward to today, and with this new ID card now widely in the hands of French citizens, France’s government has released France Identité, an app that allows any French ID card holder to get a digital version of their ID or driver’s license on their smartphone.

While the app was publicly made available earlier this year on iOS and Android, I have been using the beta for close to a full year now. France Identité is a strange, frustrating mix of physical and digital that says a lot about the privacy concerns and technical issues that inevitably get raised when a state wants to take their IDs digital.

Let’s take a look at the app, what it can do, and how it differs from Apple’s vision for digital IDs.