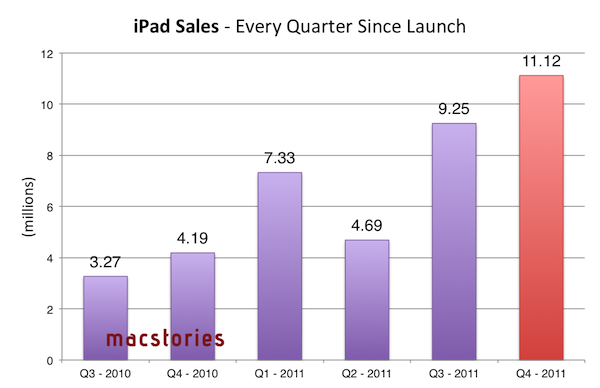

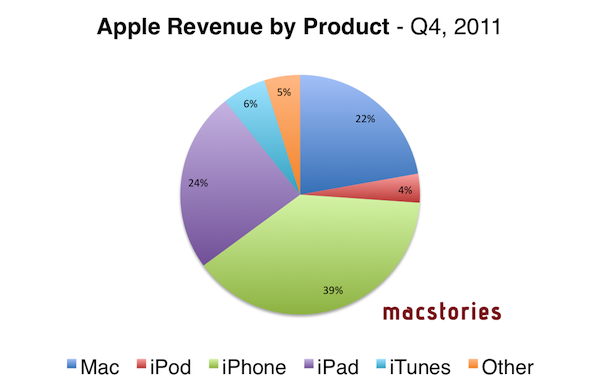

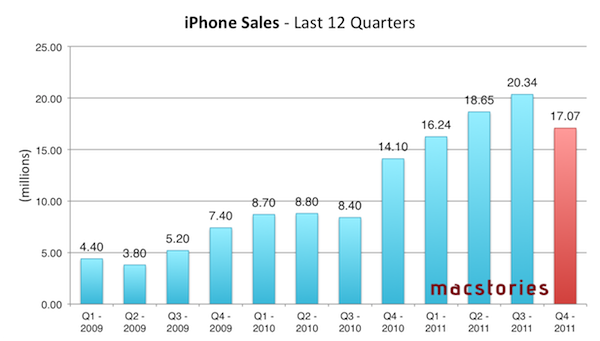

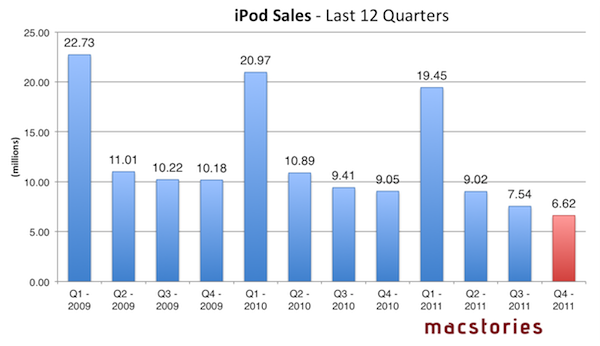

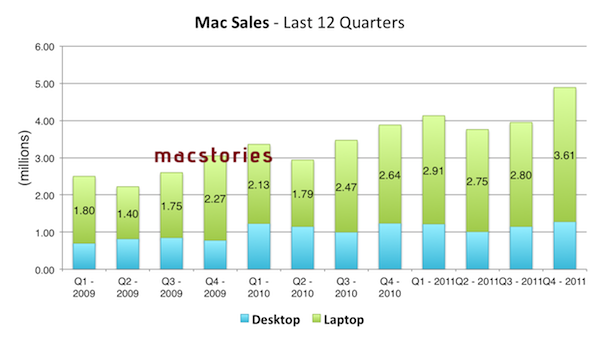

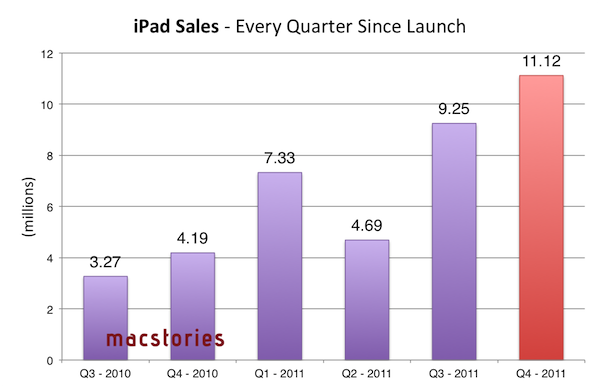

Apple has just posted their Q4 2011 financial results. The company posted record-breaking revenue of $28.27 billion, with 11.12 million iPads, 17.07 million iPhones and 4.89 million Macs sold. The company posted quarterly net profit of $6.62 billion, or $7.05 per diluted share. iPhone represented a 21 percent unit growth over the year-ago quarter; iPod sales are down 27 percent from the year-ago quarter, but Apple reported the best iPad quarter to date with over 11 million units sold and a 166% increase over the year-ago quarter. For the next quarter, Apple set guidance at revenue of about $37 billion and diluted earnings per share of about $9.30.

Estimates and Previous Quarters

Wall Street consensus’ estimate was earnings of $7.28 per share and revenue of $29.45 billion; independent analysts expected earnings per share of $9.07 and $33.47 billion revenue. In Q3 2011, Apple said they expected revenue of about $25 billion and diluted earnings per share of about $5.50 in the fourth fiscal quarter of 2011.

In Q3 2011, the company posted record-breaking revenue of $28.57 billion, with 9.25 million iPads, 20.34 million iPhones and 3.95 million Macs sold.. In the year-ago quarter, Apple posted revenue of $20.34 billion and net quarterly profit of $4.31 billion. In Q4 2010, the company sold 3.89 million Macs, 14.1 million iPhones and 4.19 million iPads, which began selling during the quarter.

Q4 2011 Recap

Apple’s fourth fiscal quarter, which ended on September 25th, saw the release of updated MacBook Air and Mac mini models, OS X Lion on the Mac App Store and, later, on USB drive, as well as a new iMac for the educational market and a new Thunderbolt Display. The company was initially expected to unveil a new iPhone in September, but a media event took place in Cupertino on October 4th, nine days after the quarter ended. iPhone 4S sales numbers will be included in Apple’s Q1 2012, but the company has already announced over four million iPhone 4S units have been sold in the first weekend of availability.

As for the Mac, the MacBook Air is widely believed to have become the crown jewel of Apple’s portable business (which no longer includes the white MacBook, discontinued in July) that, alongside Lion, was expected to boost Mac sales in the September quarter.

On August 24th, Steve Jobs resigned as CEO of Apple, and Tim Cook was elected CEO of the company. Steve Jobs passed away on October 5th.

On October 4th, Apple also announced over 6 million copies of Lion had been downloaded through the Mac App Store since July 20th (when the operating system went on sale), with Mac users approaching 60 million worldwide.

Q4 2011 Earnings Call

Apple will provide a live audio feed of its Q4 2011 conference call at 2:00 PM Pacific, and we’ll update this story with the conference highlights. Full press release is embedded after the break.

Notes from the call

- Tim Cook: Steve Jobs’ spirit will always be the foundation of Apple.

- New record sales for Mac and iPad in the September quarter.

- Mac sales increased strongly in each operating segment.

- iPod touch continues to account for half of all iPods sold.

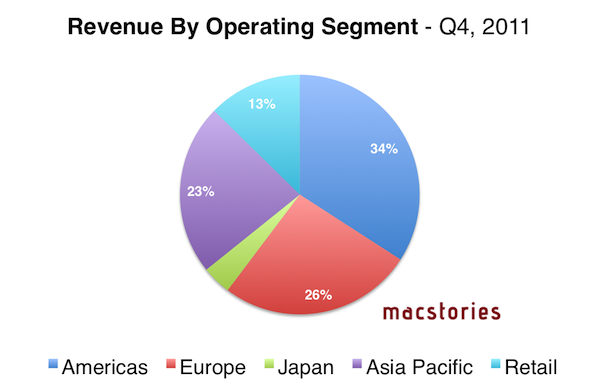

- iPhone sales double in Asia Pacific year-over-year.

- Ended quarter with about 2.5 million iPads in channel inventory.

- 92% of Fortune 500 testing or deploying iPad.

- 500,000 apps available in the App Store. Expanded the App Store to 123 countries in the September quarter.

- 30 new retail stores opened in the quarter, 21 internationally.

- $3.6 billion revenue from Apple retail stores.

- 77.5 million visitors in Apple retail stores in the quarter.

- Average revenue per store is $10.7 million.

- Apple has $81.6 billion in cash available.

- Tim: We’re confident that we’ll have a large supply for the 4S in holiday quarter and set an all-time record for iPhone this quarter.

- Tim: Progress in China has been amazing: Greater China revenue 2% in FY09; 12% in FY11. Fastest growing major region. $4.5 billion in revenue from China in September quarter.

- Apple placing additional focus on other promising areas: Brazil, Russia, Middle East. There are several of these markets where Apple hasn’t been historically strong.

- Tim: China – the sky’s the limit there.

- Tim: As iPad competitors came to the market, our share went up.

- Oppenheimer: Pervasive iPhone rumors had a definite negative impact on Apple’s business.

- 40 million iPads sold on a cumulative basis.

- Tim on iPhone 4S launch (4 million units) Vs. iPhone 4 launch (1.7 million units) last year: “That’s the mother of all uplifts”.

- Tim: Number of people using Siri already is amazing. We see this as a profound innovation. Over time many, many people will use Siri in a substantial way.

- Tim: We spend a lot of time and money and resource in coming up with incredible innovations. And we don’t like when someone else takes those.

- Tim: We still see iPhone 3GS and iPhone 4 as incredible products.

- iPad available in 90 countries.

- Tim: We are in the main countries with iPad.

- Tim: Everything we’re doing in the United States, we’re doing in China.

- Tim: Cannibalization of PC market happening in two ways. Some people choose to buy an iPad over a Mac: a materially larger number of people buying an iPad instead of PC.

- Tim: I’m not religious about holding cash or not holding it.

- Tim: We could not be happier with our position in the tablet market. We have some incredible things in the pipeline.

Graphical Visualization

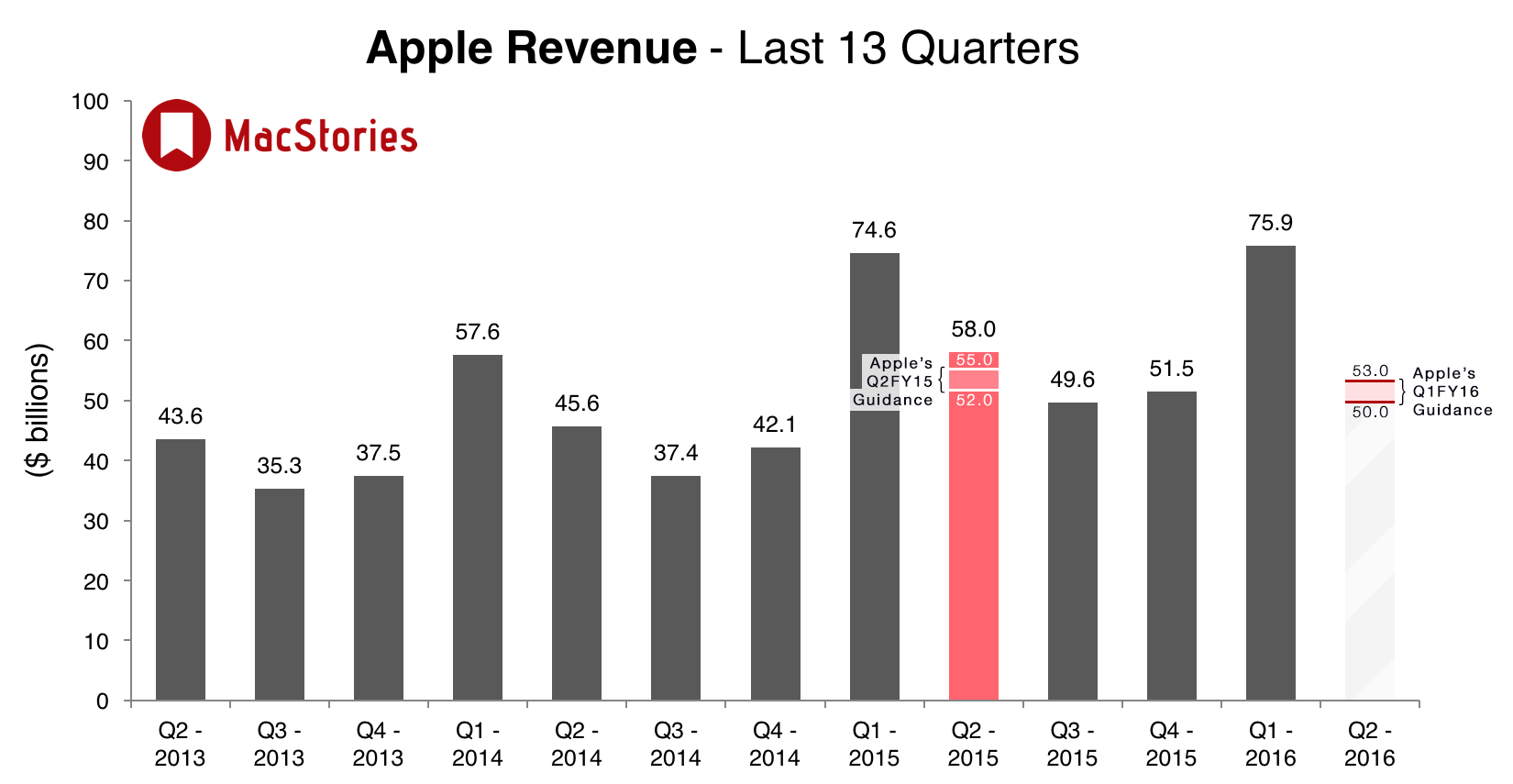

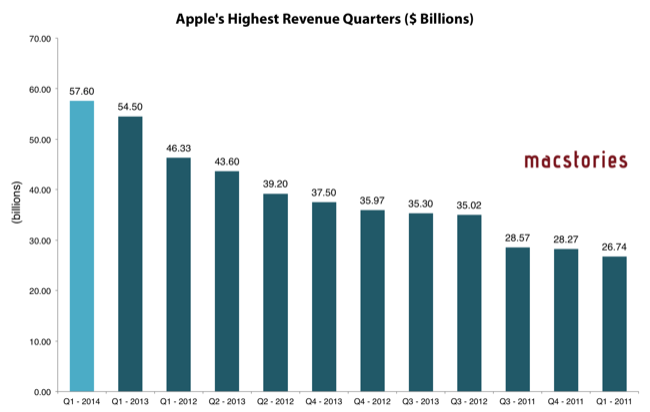

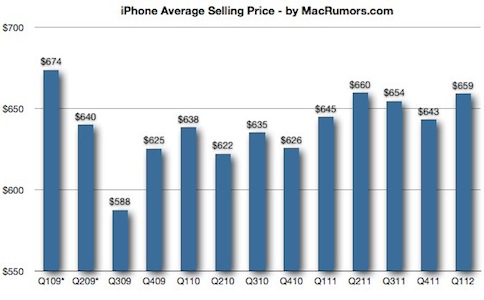

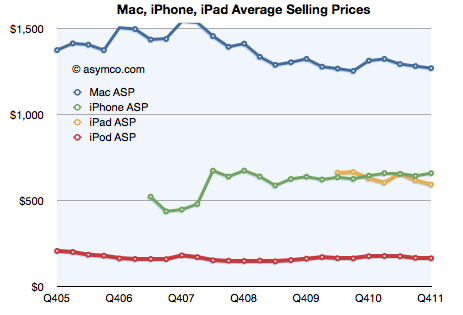

We have compiled a series of graphs and charts to offer a graphical visualization of Apple’s third quarter. Apple’s Q4 2011 data summary is available here.

Read more